Is it a bad sign when earnings come in better than expected and markets don’t rise? It could be, after all we are also at the beginning of the Halloween Indicator (“Sell in May and Go Away”), a universal phenomenon, and not something just seen in the US.

Although a more reasonable reason for a muted response to positive earnings is the rise in bond prices. Bonds are getting to the point where they are becoming a more attractive asset class and providing some competition for investment dollars. Whereas previously stocks were the only place to be we are now returning to a more “normal” environment where stocks, and bonds, coexist in an investment portfolio. So, even when there is positive news coming from stocks investors aren’t simply rushing to get on board the only investment vehicle available.

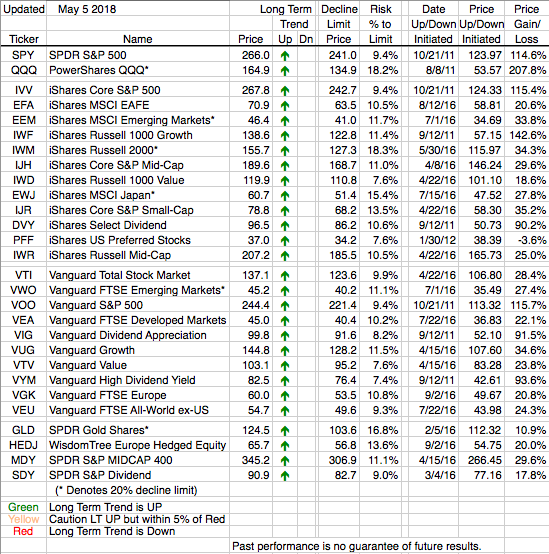

All of this in no way means we are shifting our stance regarding our equity ETFs. Far from it. We have yet to even receive a caution sign from any of our ETFs. All Green Arrows mean we are still firmly in the positive Long Term Trend camp.