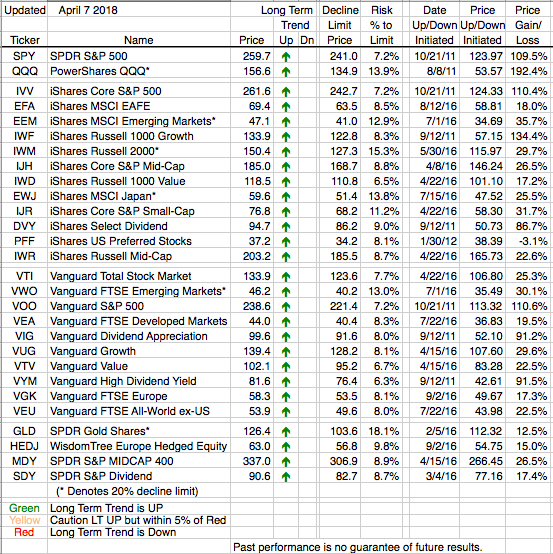

We understand if investors have developed a dismal feeling about the markets in the past month or so. It seems as if the only direction the markets understand is down. Yet given all the investor negativity almost all of our ETFs have “only” fallen about half way to where a change from Long Term Uptrend to Long Term Downtrend would be initiated. Granted, this is as close as they’ve gotten to a rating change in almost 18 months, so we guess that might deemed a reason for feeling dismal. Still, we are only half way to a rating change. The Long Term Uptrends remain.

Now, on the positive side GDP still looks good and interest rates are still more than reasonable from a historic perspective. Next week we move into first quarter earnings reporting season, and these reports should look good. Unfortunately with the recent talk of trade wars the expectations part of the reporting, that a week ago seemed to be assured as being upbeat, may now be a little more muted with talk of uncertainty regarding trade and its influence on the outlook for the end of the year. Still, overall the reports should skew to the positive side. Although this is just an educated guess on our part and is not part of our investment strategy.

We use information like the above when people find out what we do and then ask us, in a certain way, what we think about the markets. We go for the more “news worthy” information because very few people want to just hear that we’re positive because all of our ETFs are in Long Term Uptrends. Which is what we really want to say. That’s just too simple to satisfy most investors. They want the markets to be complicated and mysterious. They don’t want to hear how we try to take that out of the markets. Although occasionally someone will ask how we invest, and that’s when a real conversation begins.

And now, for your simplified markets report. Currently all of our ETFs, as previously stated, are in fact maintaining their Long Term Uptrends. Thank you for your willingness to be a long term investor, and your trust in our method.