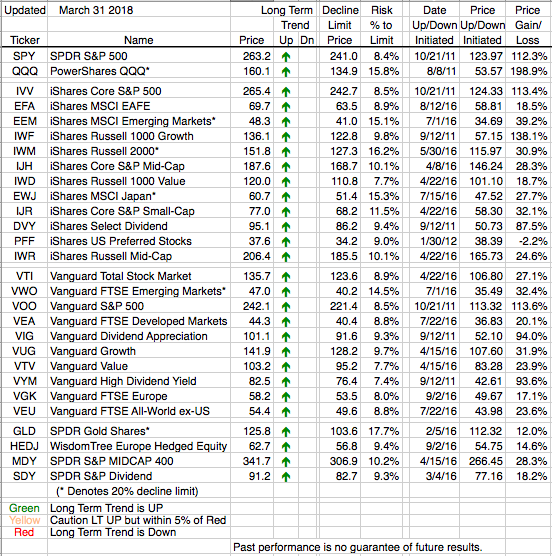

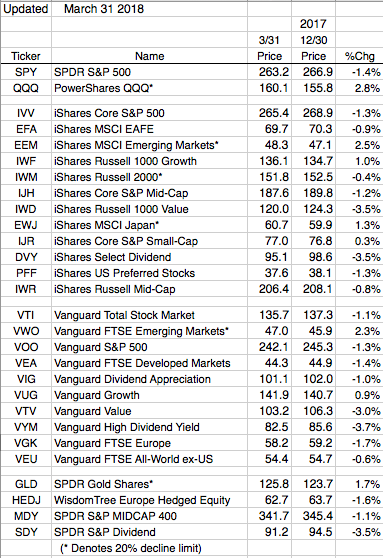

Our “growth” ETFs (e.g. QQQ, IWF, VUG, EEM, VWO) rose between 1% and 3% in the first quarter. Most of this positive performance was due to the very strong gains early in the year not being completely consumed by the declines that have been occurring recently. (Our quarterly results table is shown below after our normal weekly table)

Our “value” ETFs (e.g. IWD, VTV, DVY, VYM, SDY) all showed declines of about 3% in the first quarter. These declines are just bringing the performance of our value ETFs back into line with the performance of our growth ETFs over the past year or so, as just about all of our ETFs are now around 8% below their recent highs.

Sitting between growth and value, the S&P 500 (SPY, IVV), Mid-caps (IWM, MDY) and Developed Markets (VEA, VGK, VEU), all experienced declines of about 1.5%.

As stated above just about all of our ETFs are at least 8% above a change from their Long Term Uptrends. This means we still have no caution (i.e. yellow) arrows. All continue Green.