Last week the Commerce Department reported that 3rd quarter GDP rose 3.3%, the strongest growth in three years. Other signs of strength came from a 17 year low in the unemployment rate to 4.1% and a 17 year high in consumer confidence. Adding to this domestic strength is an expanding global economy.

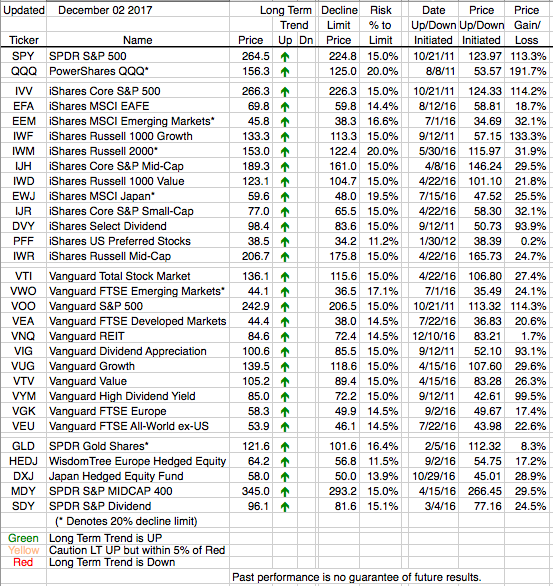

As one might expect from all this strength equity valuations are not “cheap”. Yet, when compared to interest rates (i.e. bond yields) and inflation, valuations do not appear unreasonable. Irrespective of valuations there appears to be a feeling among many investors, that in this low interest rate environment they must own stocks because there is no reasonable alternative. That might be one reason to own equities but we believe in owning them because all of our ETFs are in Long Term Uptrends.