New highs are, and should be viewed as, a sign of strength in markets and not a sign of impending danger. Sure, danger will eventually befall the market, but the decline will NOT be caused by the new highs. Rather something will happen to alter the fundamental underpinning of the market. Most likely, since the markets are forward looking (e.g. discounting mechanisms), an alteration in what is expected to occur which, should it happen, will affect earnings.

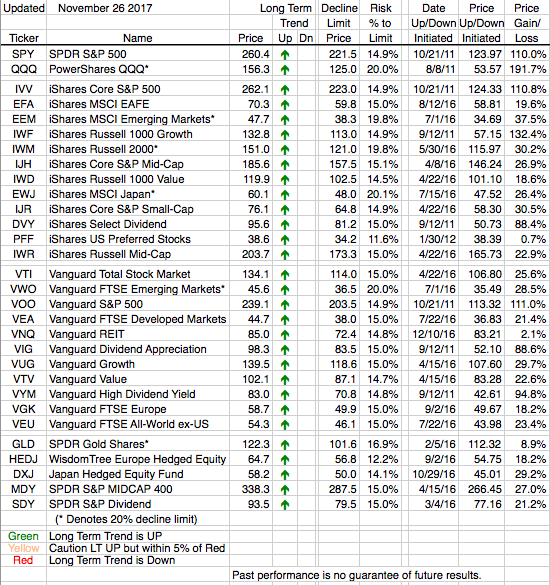

Currently the economies of most countries are moving ahead at a respectable pace.This global economic expansion is benefitting all of our ETFs and all of he these new highs indicate that is expected to continue. At some point this growth will change but we have no idea when. We do know that in all likelihood the markets will anticipate this change and begin their decline before the actual earnings numbers get reported. Should the problems, whenever they might occur, become significant we have the comfort of knowing that our risk is limited to 15% of these recent highs. (The more volatile ETFs are allowed a 20% decline.)