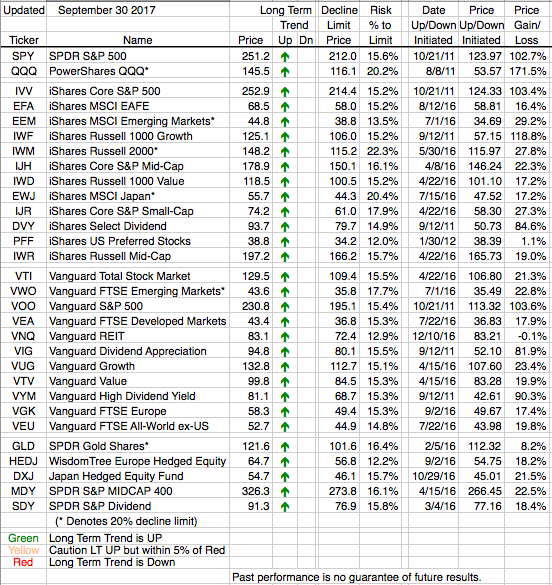

All but one of our ETFs posted gains in the third quarter with most gains being in the 3%-5% range. The lone decliner was iShares US Preferred Stocks (PFF). As one might expect this ETF trades more like a bond ETF and not one of our equity ETFs, but technically it is equity so as one of the top 30 equity ETFs it is on our list. Even so it declined less than 1% in the third quarter and is up over 5% this year.

Year to date all of our ETFs are up, lead by foreign markets (both emerging and developed) and technology (QQQ). All of these are up about 20%. The US focused ETFs have generally shown gains this year of 8%-14% with growth stocks being a little above that range (thank you tech).

Going into the fourth quarter we expect all markets to continue their upward moves. Earnings, the real driver for stock prices and therefore ETF performance, still appear solid, and with rates remaining low, albeit on a gradually rising trend, the backdrop appears favorable. More importantly, at least to us, is that all of our Arrows Remain Green.