The first quarter was solid with gains for all our covered ETFs, and most of those were in the 5%-10% range. At the higher end for the quarter were Emerging markets and QQQ with low double digit gains. Large cap U.S. and European focused ETFs had upper single digit returns for the quarter. Smaller stock ETFs, after having a strong end to last year, were at the bottom with respect to gains, in the first quarter as they had low single digit returns.

For the week the returns were almost the inverse of the full first quarter’s as smaller cap ETFs had the best returns, up 1%-2% and Emerging markets (EEM, VWO) had the worst returns, declining a little over 1%. Although QQQ continued to show strength as it gained a little over 1%.

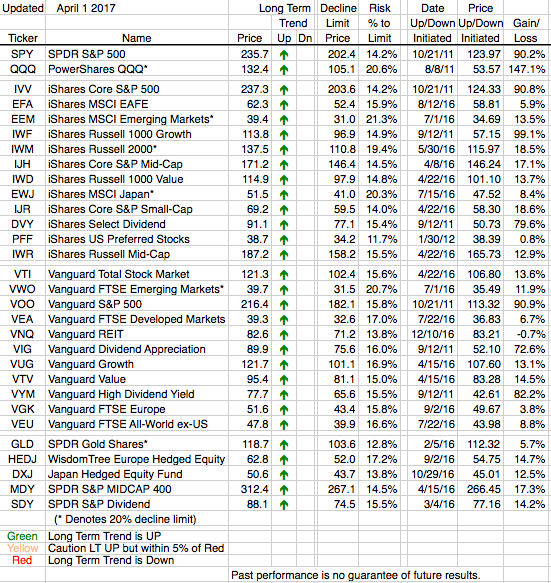

We know it seems repetitive, but, as all markets continue to march higher our signals don’t change. All arrows are green (i.e. showing long term uptrends hence a sign of comfort). That doesn’t mean there aren’t storm clouds on the horizon, we don’t know whether there are or there are not because we don’t make predictions, but it does mean the sprinkles haven’t started yet, so it’s safe to play outside.