Everyone seems to be trying to predict when the short term rally that started after the election will end. Very few professional investors predicted the rally, yet now we are supposed to listen to them telling us when it will end?

We can not emphasis enough, the less investors listen to market pundits the better off those investors will be. It has been proven over and over again, no one knows when a rally will start, or end. Don’t try and pretend that market movements can be ascertained before they occur. No one will be able to catch the stock market top, or bottom, but if you miss those you still have the middle 70% of the move to profit from.

Investing can, and should, be a relatively simple process for the vast majority of investors. Follow the market movements and try (the operative word in this sentence) and be in when the market is rising and out when it’s falling.

Individual investors should be spending no more than 15 minutes a week thinking about the stock market. Let the market tell you how it’s acting and how you should be reacting.

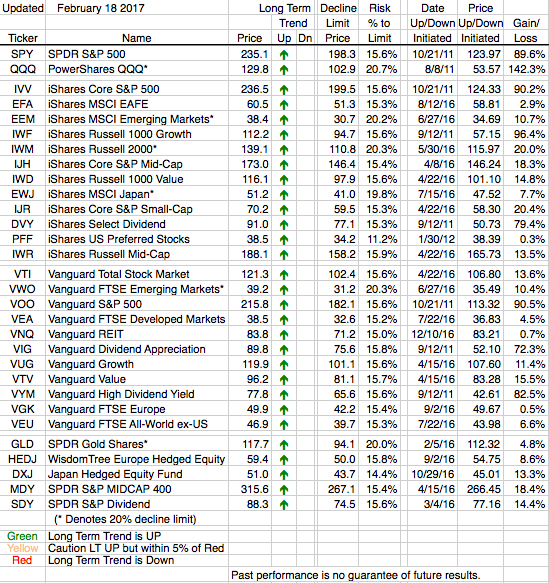

As can be seen by all the green (go) arrows in our table below the market is currently in an uptrend. It’s good to be invested in a market that’s trending up. Now that’s some quality market punditry.