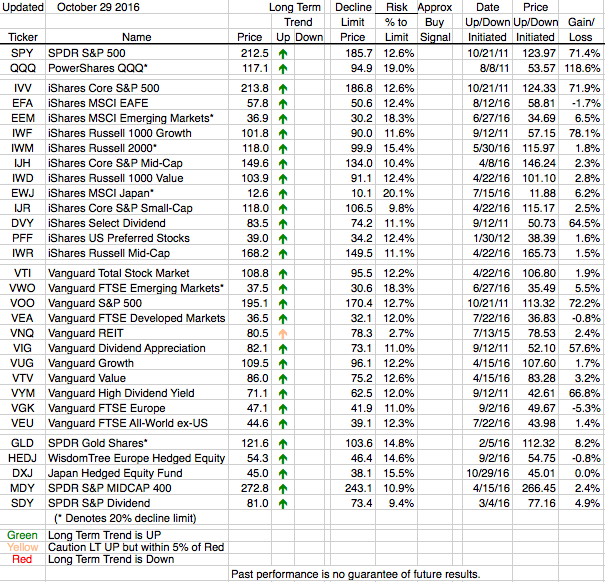

As bad as the markets have felt recently, thank you financial press, all but one of our ETFs (VNQ being the exception) are within 3% of their highs. This is not indicative of a weak market. It should be viewed as a sign of a fairly strong one.

Fears about the markets abound. Most centered on an interest rate hike by the Federal Reserve. Yes, the Fed will raise interest rates, not this week but most likely at its meeting in December. But doesn’t that show an improving economy with higher earnings, and not something to fear? Has the market been driven solely by the fact that “there’s no place else to invest” or are we still actually investing in companies that have fundamentals that create value? We hope, and believe, it’s the later, and as such the market should not fear an increase in interest rates. Especially an increase from historically low rates.

However, what an investor feels the market “should” do and what it actually does are often not the same. It’s fairly easy to envision a short term negative reaction to an increase in rates. Remember though, we are long term investors, not short term traders. Over the long term improving company fundamentals created from a growing economy should trump investor fears of higher interest rates. Therefore we feel comfortable that our ETFs are telling us to stay invested in the markets despite the expected increase in volatility.

Our only change this week is that the previously mentioned VNQ is now on a yellow arrow (a caution rating due to it being within 5% of a Long Term downgrade) from its previous green arrow.