Two weeks ago there were minor losses across the board this week minor gains. So we’re slowly moving into Earnings Season with no real changes to our positive positions.

There is something we want to caution or readers about. Each and every day the financial press needs to write articles to pique the interest of investors. This even if nothing is really happening. As is the case now. Please do not worry, or get euphoric, about what you read in the financial press. Our belief, and it has proven to work fairly well, is to simply follow the price of our ETFs and let them tell us when the risk seems high or low. After all stock prices contain not only the beliefs of investors but also the actions of investors. And, as we all know, actions speak louder than words.

Look at the two headlines below. These were actually posted right next to each other. One saying the market is going to go up, the other saying it is going to go down.

This is the media at its’ “best”, drumming up investor interest (i.e. fear or greed). Both headlines are eventually going to be correct, one before the other, but is there a way to actually know in which order they will occur? No, but you can participate in the gains and still limit your losses if you are willing to pricing to dictate your action and not the media. At Averting Aversion we are trying to help you with that.

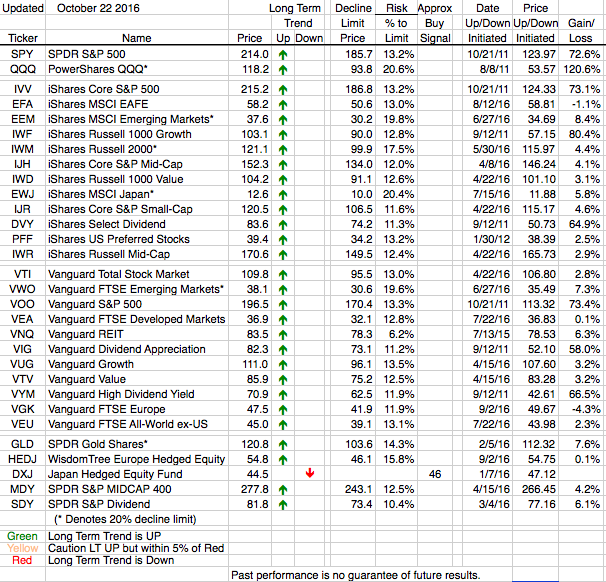

The table below shows that at this time all but one of our ETFs is signaling that we are most likely to continue participating in gains. We know this isn’t a certainty but should the market turn the other way we have the comfort of our 15% Rule, thereby limiting our declines.