Over the past few weeks (months?) investors have attributed the ups and downs of the markets to a number of events, all of which, or none of which, may have been responsible for the trading activity. Now we are entering a time period when investors can actually look at companies operating fundamentals to help determine their share price. People, let the games begin, it is finally earnings season.

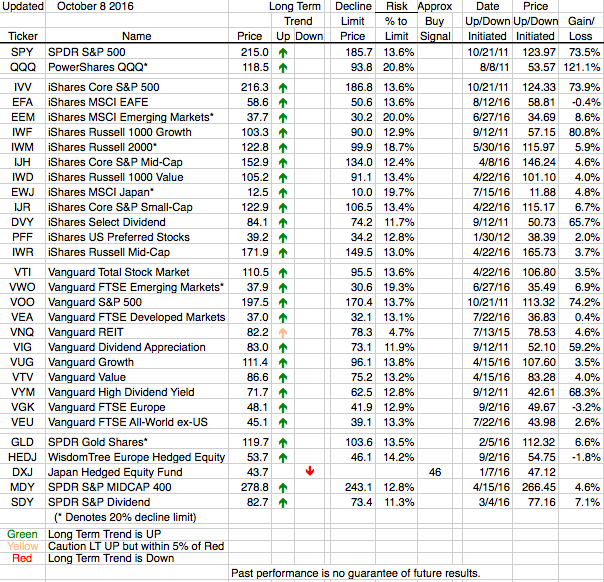

We had one minor change to our ETF rankings this week. The Vanguard REIT ETF (VNQ) moved from Green to Yellow. That means it is now within 5% percent of signaling it is in a Long Term downtrend. This is not a sell signal, just a cautionary note. S&P carving REITs out of the Financial Sector and giving them their own sector (XLRE) hasn’t seemed to help their performance.

We did have one area of stability last week and that was, surprisingly, emerging markets. As all the other ETFs were losing 1/2% to 1%, or a few a little more, the emerging markets ETFs were holding their own.