Most of our covered ETFs declined about 2% on Friday. This comes off of all time highs for just about every one of these ETFs. What this means is that they would have to fall about 12% more for their long term trend to move from buy to sell. That’s quite a move for the largest ETFs, and unlikely over the near term. So, our current investment strategy would be to RELAX and stay invested.

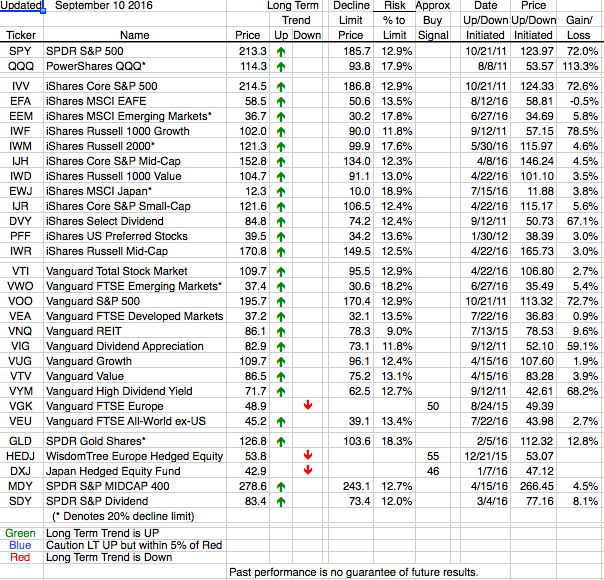

The table below shows how little weakness we’re finding in the markets. All but three of our ETFs are on Long Term Uptrends and not close to sell signals. If the markets were to fall another 10% then we would start thinking about looking to take action. To emphasize, that is when we would start thinking about taking action, not actually taking it. Hence, our recommendation to RELAX.

If you feel like you want to get ahead of everyone else and start selling your ETFs before that trade becomes crowded we recommend you employ one of the best trading strategies we know. Just sit on your hands. More often than not that proves to be the best thing to do.