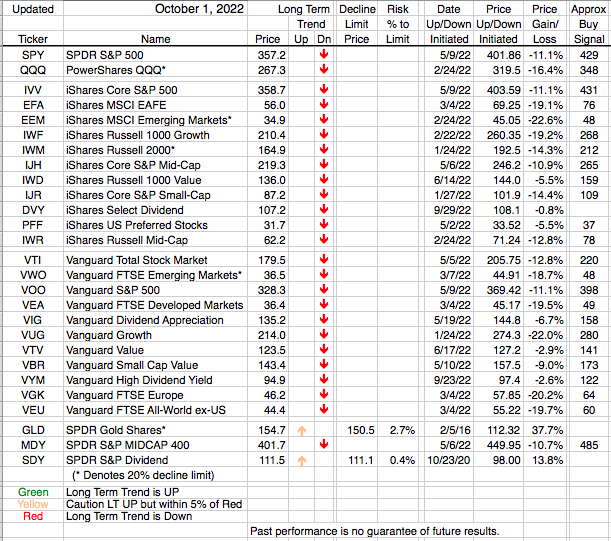

The 3rd quarter was, unfortunately, the third consecutive quarter of lower ETF prices. Most of our ETFs had declines of 5%, plus or minus, which is not good but is a slowdown from the double digit declines of the second quarter. Europe and Emerging Markets ETFs were the exception to the improving declines as they fell at a low teens level.

All but two of our ETFs are in Long Term Downtrends, and the two that are not have to be monitored closely because they are very close to moving there. And even though many of our ETFs have declined in the high teen range since they went into LT Downtrends there are not any that are close to their Approximate Buy Signal. But with significant declines already it is possible we might see a change in the not too distant future. Or at least some sort of stabilization as we move into historically the best six month period for stocks (i.e. November to May). Although we are not trying to predict when we will get a signal to change trends. We will wait for the markets to give us that signal and then we will post our trend changes.

Here’s hoping we don’t see four consecutive down quarters.