Perusing media we are led to be believe that just about all the news is negative and is leading to terrible results in the stock market. There is in fact a lot of bad news out there but it is not having the significant negative impact on the market that most of the media seems to be espousing.

Here’s a rather startling number, 2.2%. That is how far the S&P 500 is off it’s record high. Given all the doom and gloom that’s been reported the last couple of weeks one would have thought the market should have been down at least 10%. That is simply not the case. The market has proven it is fairly resilient.

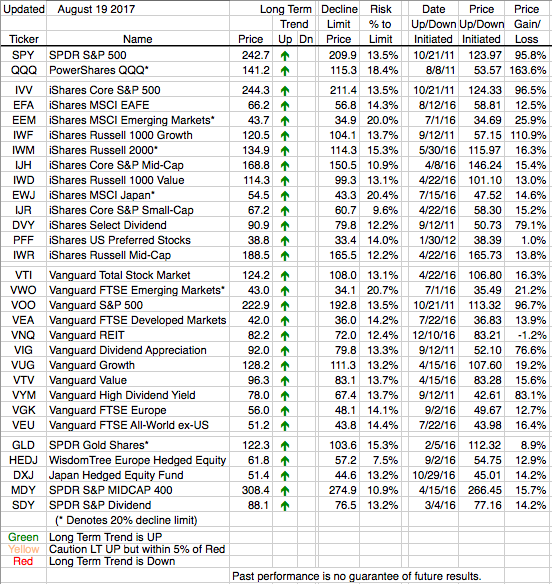

Markets have not been performing poorly, and in fact foreign markets continued to perform well last week, even with the terrorist attack in Barcelona. Emerging markets showed the strongest gains with EEM and VWO advancing 1.7% and 1.5% respectively. Smaller domestic stocks were on the other end of the spectrum last week with declines of 1.5% for the iShares S&P Small Cap ETF (IJR) and 1.1% for the iShares Russell 2000 (IWM). Although we need to remember these small cap ETFs (IJR and IWM) are still up 15% over the past year.

We continue to be positively predisposed toward the markets as all our ETF arrows are green.