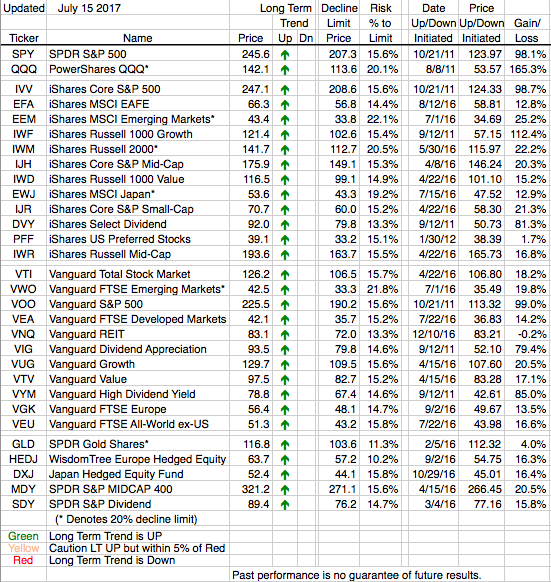

Even though it seemed all commentary last week was focused on the Federal Reserve and their continuation of easing monetary policy it was actually the foreign markets that had the best performance. Our Emerging Market ETFs (EEM, VWO) showed some real strength with gains of 5.5% and 4.7% respectively. Our European ETFs (VGK,EFA) also had a good showing as they both rose 2.3%. The All-World, ex-US, ETF (VEU), and the Developed World ETF (VEA) did a little better than just Europe, as might be expected, and were up 2.9% and 2.4%.

Domestically, our technology ETF (QQQ) tried to keep up with the foreign ETFs as it rose 3.2% on the week. The S&P 500 ETFs (SPY, IVV) had a very respectable week gaining 1.4%.

All of our ETFs showed a gain last week and continue showing strength as they all (with the sole exception of HEDJ) trade near their highs. There is not a Yellow, caution, Arrow in sight. Therefore we are still positive on all of our ETFs.