Last week domestic equity ETFs showed neither gains nor losses. Yes, they were flat on the week. Foreign ETFs did post slight losses but those were basically just rounding error. All of the foreign declines were less than 0.5 points with the sole exception being Japan (EWJ) which was down 0.7 points, or 1.2%. Gold (GLD) was the only ETF showing any “real” decline as it slipped 2.3%.

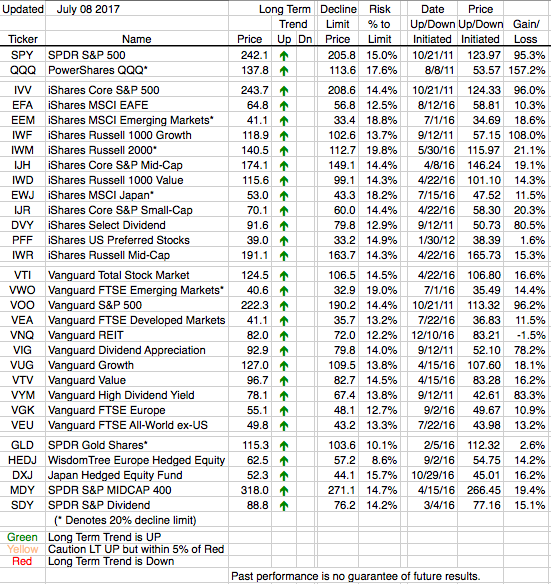

Given all the talk last week of impending (and ongoing) central bank interest rate hikes, at the end of the week the market proved fairly resilient. Over the next few weeks companies will be reporting earnings and that is what investors, with their short term orientation, will be focusing on. We don’t know how earnings will turn out, currently pundits expect them to be above reduced expectations (whatever that means), but all of our ETFs continue to have Positive Long Term Trends, so it appears the stocks are trying to tell us the earnings should be OK. If that’s not the case at least we know what our downside risk is. (Hint: No more than 15%, or 20% for higher volatility ETFs, and it can be found in the table below under Risk % to Limit)