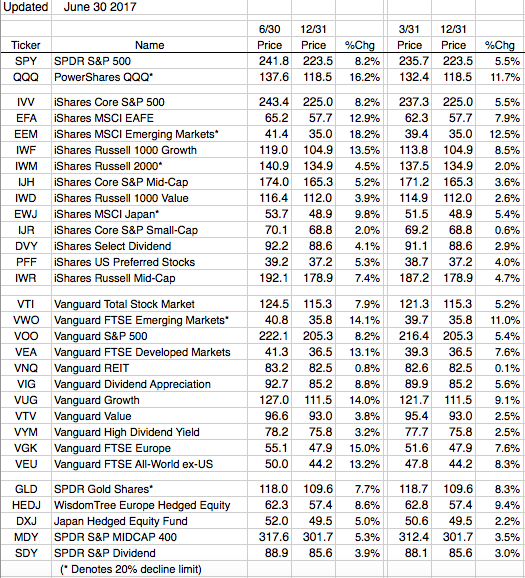

Our strategy had an excellent first half of the year as all of our ETFs were on Green Arrows (i.e. Long Term Uptrends) the entire first half, and all our ETFs posted gains. As shown in the second table below, Nine of our ETFs had double digit gains in the first half. This group includes Foreign focused ETFs, Emerging and Developed markets as well as Europe, domestic Growth ETFs, and the QQQ’s. All our other ETFs had single digit gains.

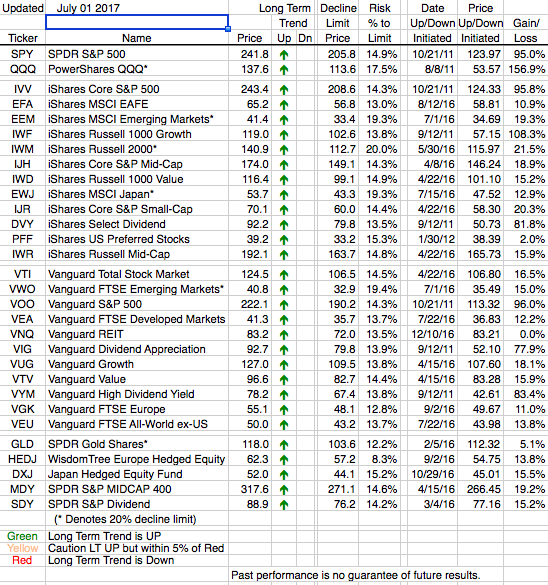

We’re starting the second half as we started the first with all of our ETFs on Green Arrows. We expect more volatility in the markets but we don’t know whether or not this increase in volatility will lead to a decline in prices significant enough for any of our ETFs to shift their trend Long Term Up to Long Term Down. Currently none are near a move in that direction.

The market pundits have picked up the drumbeat of an imminent market decline, but they’ve been leaning that way for much of the first half and that was far from what happened. Our philosophy is to watch the Long Term trends and let them be our market guide, not the day to day prognostications of the pundits. Eventually the naysayers will be right, and let us know they saw a decline coming, but until that time we will let market pricing dictate our stance, and pricing is telling us to maintain our positive position.