The ostensible technology ETF (QQQ) rose a little over 2% last week helping the overall domestic stock market (SPY, IVV and VOO) to be basically flat on the week. European markets (EFA, VEA, VGK and VEU) did not have the same luck as they each declined over 1%. Interestingly dividend focused ETFs (VYM, VIG, SDY and DVY) also suffered declines of over 1%. This despite the fact interest rates declined last week. As we said in our previous piece, “financial markets are confusing”.

Oil was a topic of conversation last week as prices moved toward recent lows and more than a few market pundits were using oil prices as a reason for the stock markets daily moves. That may, or may not, have been the case (we don’t look for why the market moves we pay attention to the move itself) but irrespective of the reason for the market moves the price of oil is still intriguing. The reason being, a lot of the earning improvement expected for the market this year was to come from energy companies recovering from their very depressed earnings of the past few years. If the price of oil continues to fall, or even stays in the low 40’s, it will likely become difficult for many of the energy companies to meet earnings estimates. This obviously means it will be difficult for the market, as a whole, to reach its earnings target.

The “good” news in all of this is that the issue for oil is not a decline in demand, which would mean a weaker economy, but rather increasing supplies of oil as companies take advantage of advanced drilling operations to increase their production. These advances also reduce the cost of production so a lower oil price doesn’t hurt as much as one might expect. It’s effect is still negative, just not as much.

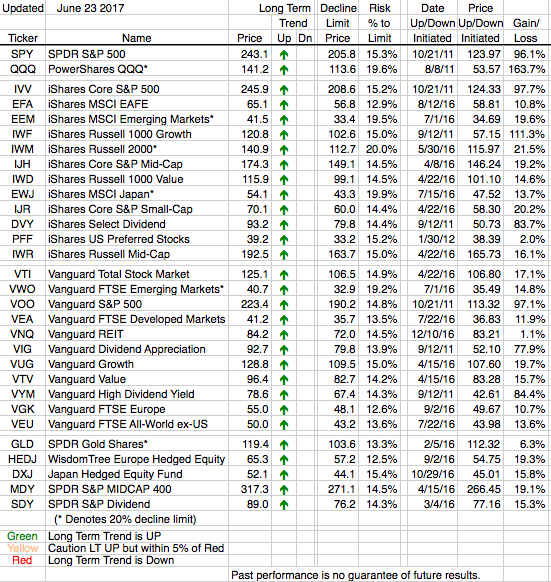

It seems every year earnings expectations for the market steadily decline as the year progresses and this year looks like it will be no exception. Weaker energy earnings may be a reason for the stock markets overall lower earnings but they are NOT a reason to start lightening up on stocks. All of our Long Term Trend arrows continue to be pointing higher with none of our covered ETFs remotely near their respective caution zones. Stay the course.