The market was indeed confusing last week, but it’s always confusing. Despite the fact financial pundits would like to convince investors there are specific reasons for daily directional moves the reality is that what caused an increase or decrease on any particular day is usually not easily ascertained. Irrespective of what direction the market actually trades on any particular day the talking heads will tell you why it happened. But often they don’t know why, all they know is that the information they’re given supports the direction the market took that day. As long as their “rational” makes sense it doesn’t matter if it’s the actually reason or if it’s happenstance. People will, unfortunately, listen.

We must remember, market pundits, especially those on TV, are there to entertain and sell advertising. Don’t ignore them at your peril. Patience is an investors best friend not screaming remarks coming from your preferred viewing screen.

Patience, and calm decision making, are things we try to help investors with. We feel investors should be in this for the long haul. The market, like the economy, has a positive bias, but that doesn’t mean it will always go up. Nothing does. We just try to let the market tell us, through a decline in prices, when that bias seems to have temporarily shifted, and then we let our readers know.

We don’t give reasons why our ratings change. That’s not because we can’t come up with some but because our “reason” is simply the movement of each ETFs price. After all price is the ultimate assimilator of all available information. Some may have this information sooner than others and start the price moving in a specific direction but if that direction continues it’s because others are coming to the same realization.

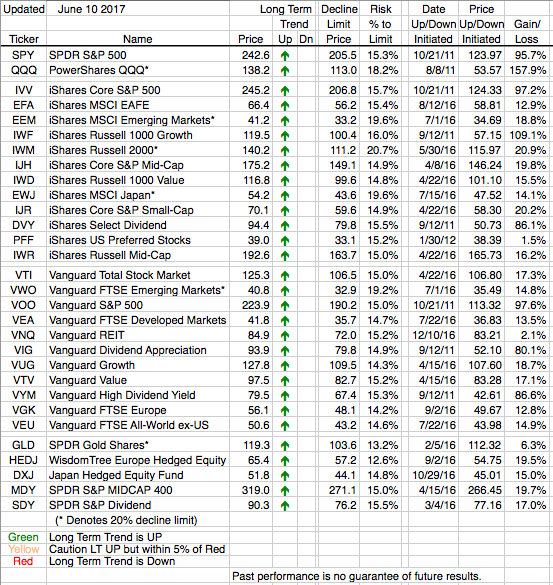

Right now, despite all the confusion and constantly conflicting stories coming from the market pundits, for us nothing has changed. All of our ETFs are still where they started the year, on Green Arrows and in Long Term Uptrends.