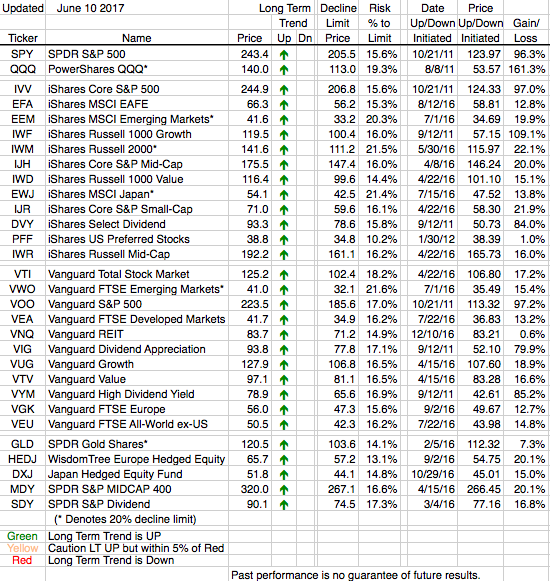

The tech ETF (QQQ) was the big loser last week falling almost 2.5%. Just about all of that decline came Friday after a major brokerage firm said the leading tech stocks (i.e. the FANGs, Facebook, Apple, Netflix, and Google) had run up too much and should be sold.

Offsetting this was solid performance from U.S. centric ETFs. That is, small and mid-cap ETFs, who by there very nature have a domestic focus. Small capitalization ETFs (IWM, IJR) were up about 1.5% and the the Mid-caps (IJH, MDY) were up about 0.5%.

Europe and the Developed markets (EFA, VEA, VGK) were down about 1.5% as they just slogged through the week dribbling down a little bit day after day.

None of the performance we saw last week has changed a thing about our Long Term Trend for each of our covered ETFs. All arrows are still Green with nothing even close to the caution zone.