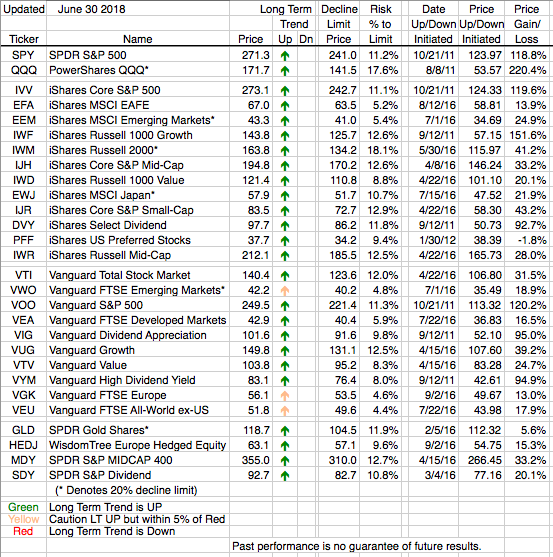

Over the past few weeks we have been commenting about weakness we were seeing in our European and Emerging Market ETFs and that weakness has now led to some of them being within 5% of a trend change. Strangely the iShares European and Emerging Markets ETFs (VWO, VGK and VEU) are slightly below the 5% threshold and the Vanguard ETFs (EFA, EEM) are slightly above that threshold. This does not speak to the merits of one product over the other it’s simply mathematical computations. The differences are very slight, and if we didn’t use decimal points both the Vanguard and the iShares ETFs would be 5% away from their respective trend change numbers.

We again remind readers that the Cautionary Arrows are simply that, Cautionary, and not a warning of an imminent Trend change. This is the time to keep a close eye on the ETF’s price just in case they fall below the Trend Change price.