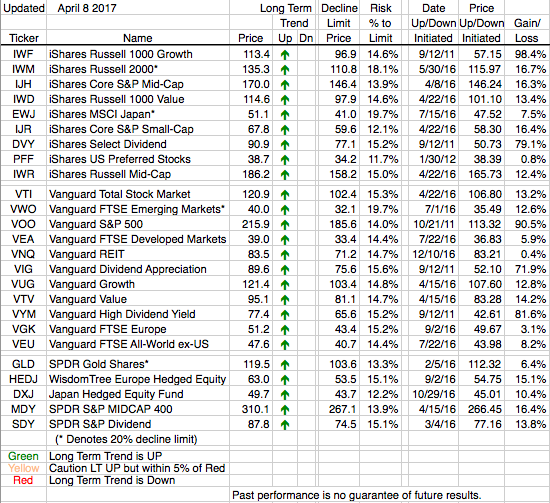

Even with a number of seemingly significant negative events during the past week (e.g. weak auto sales, FOMC thoughts about the stock market being overvalued and the idea that the Federal Reserve should reduce the size of its balance sheet, and the unilateral bombing of Syria) all but two of our large ETFs showed declines of less than 1%. Both of the larger declines were from the smaller cap ETFs (IWM and IJR) which fell 1.5% and 1.9% respectively. Emerging markets, REITs and Gold posted slight gains on the week.

In this resilient market we have no ETFs with negative Long Term trends nor do we even have any close to their caution level (i.e. 5% away from a Long Term trend change).