The “Sell in May and Go Away” axiom is one of the most popular and also one of the best performing market timing strategies. The S&P 500’s historic return from May 1st to October 31st has been deminimus, with just about all the historic return attributable to the other six months of the year. But, as Mark Hulbert recently pointed out in his column on Marketwatch, the real damage has occurred in the third year of presidential cycles. Although the historic returns for the six months from May through October are still quite a bit lower than the other six months of the year they are only negative in the third year of a presidential cycle.

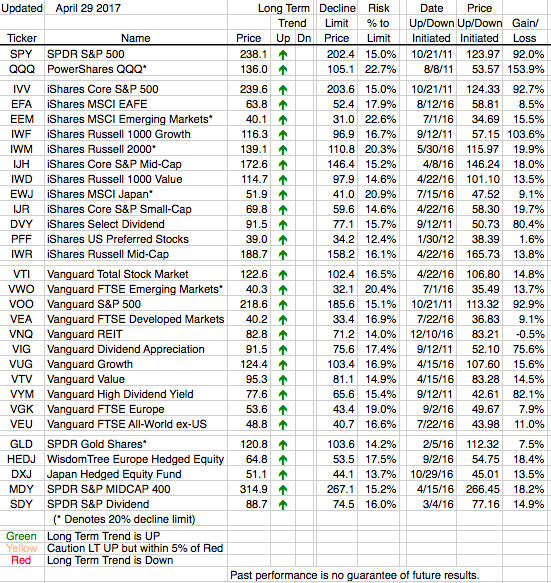

Obviously we are not in the third year of a presidential cycle, but even if we were we wouldn’t recommend one abide by the “Sell In May” axiom because all our arrows are currently green. Signaling nothing but positive Long Term Trends. In fact, our arrows for both the S&P 500 and Nasdaq have been green for each of the past five “summers”, and over that period they both had positive returns.

Not only are all of our covered ETFs on Long Term Uptrends all of them are either at new highs or very close to them. Right now we are not looking to sell.