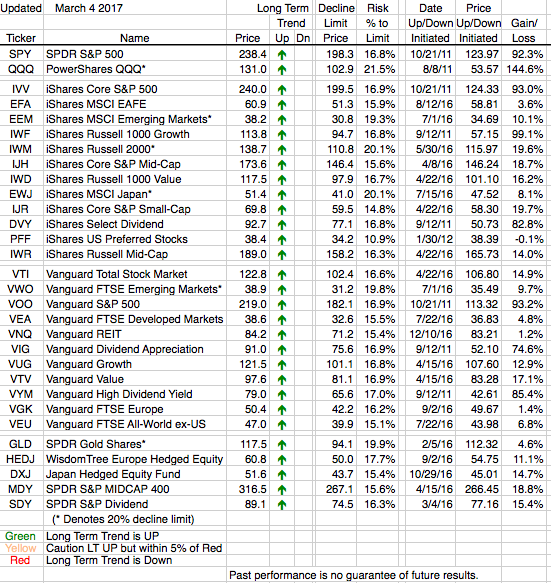

The “Trump” (economic optimism) rally slowed some last week as investors seem to be convinced the Federal Reserve will hike rates at its coming meeting March 14-15 and this hike will not get a good reaction from the equity markets. The March 15th date will certainly not be as bad for the markets as it was for Julius Caesar, but that’s about all we can be absolutely sure of regarding how the markets will react to the Federal Reserve’s decision on interest rates. What we can be sure of is that all of the ETFs we follow are in Long Term Uptrends, without any of them even near a trend change. Meaning, we’re still positively predisposed toward all of these markets. It’s not yet time to be nervous. Relax, and enjoy.