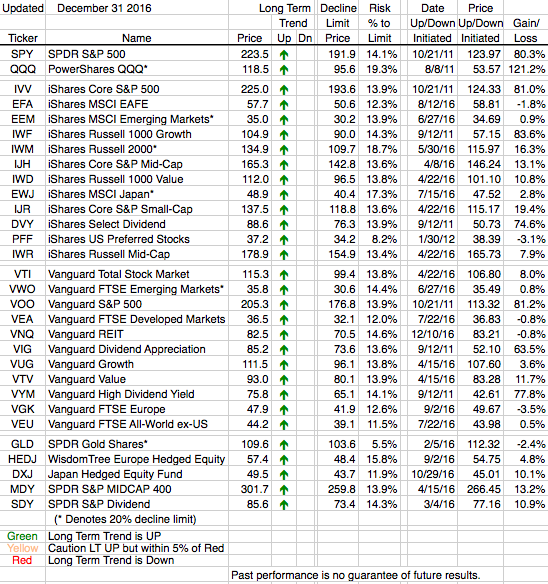

All our ETFs ended the year in Long Term Uptrends. Showing how much strength they have had all but two of them are more than 10% away from a trend change.

During the year our system did signal a number of trend changes. 21 of our 30 ETFs changed from Uptrends from Downtrends and most of these changes occurred in the first half of the year viagra online generic. 15 of the 21 ETFs, whose trends changed to positive, had gains this year, with eight of them posting double digit increases. Of the remaining six, whose trend changed to positive but the ETF had a negative return, the largest decline was only 3.5%. The positives far outweighed the negative.

In 2016 the S&P 500, the index for the largest ETFs, increased almost 10%. Small stocks, which display a distinct domestic bias, doubled that increase with an almost 20% gain. Our system fortunately had the S&P 500 index ETFs invested for the full year, but like many other investors our system started the year cautiously on small caps. Fortunately for us our system moved to Long Term Uptrends on the small cap ETFs in April and May and we were able to catch most of the annual gain.

All in all, it was another good year for our system.