Last week was a nice respite from the seemingly constant small declines of the past few weeks. Hopefully it will make it a little easier to feel comfortable with your investments.

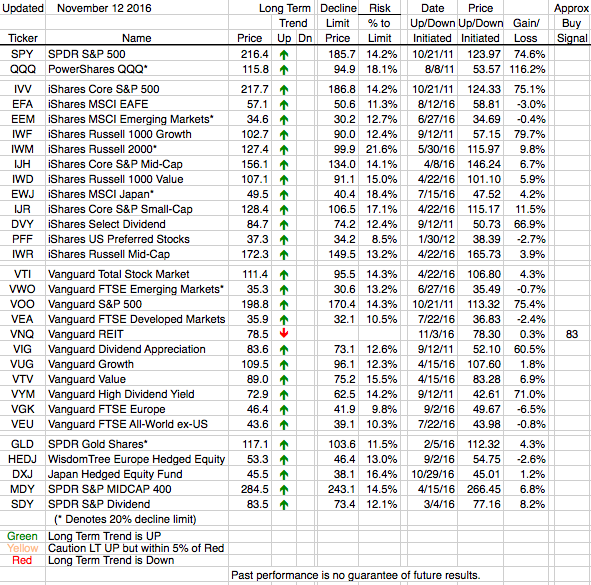

As might be expected the S&P Small Cap ETF (IJR) and the Russell 2000 ETF (IWM) both performed exceedingly well last week, up 10%, after the election of a domestically focused president. That makes sense since small caps stocks are generally more focused within the boundaries of the U.S. than are their large cap contemporaries. Even so the larger U.S. focused stock indexes (e.g. SPY, VOO, VTI, IJH etc.) responded well to the results of the elections with gains generally in the 4%-5% range as hope for a more business friendly environment is priced into the stock market.

Emerging markets were not as lucky as the U.S. markets. The two main emerging market ETFs, EEM and VWO, both suffered declines last week of about 3.5%. Although both are still firmly in a long term positive trend, needing almost 15% declines from these prices to change that.